Lost Decade, Here We Come

“Those countries with serious fiscal challenges need to accelerate the pace of consolidation,” it added. “We welcome the recent announcements by some countries to reduce their deficits in 2010 and strengthen their fiscal frameworks and institutions”.These words were in marked contrast to the G20’s previous communiqué from late April, which called for fiscal support to “be maintained until the recovery is firmly driven by the private sector and becomes more entrenched”.

It’s basically incredible that this is happening with unemployment in the euro area still rising, and only slight labor market progress in the US.

But don’t we need to worry about government debt? Yes — but slashing spending while the economy is still deeply depressed is both an extremely costly and quite ineffective way to reduce future debt. Costly, because it depresses the economy further; ineffective, because by depressing the economy, fiscal contraction now reduces tax receipts. A rough estimate right now is that cutting spending by 1 percent of GDP raises the unemployment rate by .75 percent compared with what it would otherwise be, yet reduces future debt by less than 0.5 percent of GDP.

The right thing, overwhelmingly, is to do things that will reduce spending and/or raise revenue after the economy has recovered — specifically, wait until after the economy is strong enough that monetary policy can offset the contractionary effects of fiscal austerity. But no: the deficit hawks want their cuts while unemployment rates are still at near-record highs and monetary policy is still hard up against the zero bound.

But what about Greece and all that? Look, right now sovereign debt problems are taking place in countries with a very specific problem: they’re part of the euro zone, AND they’re badly overvalued thanks to huge capital inflows in the good years; as a result they’re facing years of grinding deflation. Countries not in that situation are not facing any pressure from the markets for immediate cuts; as of this morning, 10-year bonds were yielding 3.51 in Britain, 3.21 in the US, 1.27 in Japan.

Yet the conventional wisdom now is that these countries must nonetheless cut — not because the markets are currently demanding it, not because it will make any noticeable difference to their long-run fiscal prospects, but because we think that the markets might demand it (even though they shouldn’t) sometime in the future.

Utter folly posing as wisdom. Incredible.

******

Madmen in Authority

Rereading my post on the folly of the G20, it seems to me that I didn’t fully convey just how crazy the demand for fiscal austerity now now now really is.

The key thing you need to realize is that eliminating stimulus spending, while it would inflict severe economic harm, would do almost nothing to reduce future debt problems.

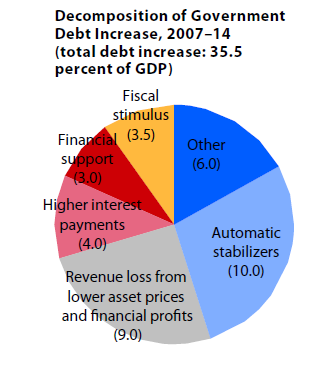

Here’s the IMF’s estimate of sources of the growth in debt over the next few years:

And even this figure conveys a misleading impression of the importance of stimulus spending.

First, since cutting stimulus would weaken the economy, it would reduce revenues — that is, a substantial part of the debt growth the IMF attributes to stimulus would have happened even without stimulus, through lower revenue.

Second, for the US at least the core reason for long-run budget concern is rising health care costs — in fact, health cost control is the sine qua non of long-run solvency — which has nothing whatever to do with how much we spend on job creation now.

So how much we spend on supporting the economy in 2010 and 2011 is almost irrelevant to the fundamental budget picture.

Why, then, are Very Serious People demanding immediate fiscal austerity?

The answer is, to reassure the markets — because the markets supposedly won’t believe in the willingness of governments to engage in long-run fiscal reform unless they inflict pointless pain right now.

To repeat: the whole argument rests on the presumption that markets will turn on us unless we demonstrate a willingness to suffer, even though that suffering serves no purpose.

And the basis for this belief that this is what markets demand is … well, actually there’s no sign that markets are demanding any such thing.

There’s Greece — but the Greek situation is very different from that of the US or the UK. And at the moment everyone except the overvalued euro-periphery nations is able to borrow at very low interest rates.

So wise policy, as defined by the G20 and like-minded others, consists of destroying economic recovery in order to satisfy hypothetical irrational demands from the markets — demands that economies suffer pointless pain to show their determination, demands that markets aren’t actually making, but which serious people, in their wisdom, believe that the markets will make one of these days.

Awesome.

No comments:

Post a Comment